Action 5: Find Your house

Together with vetting you, lenders evaluate the household concerned. Once the household serves as equity so you can keep the financing, real estate loan lenders need to make yes it’s well worth what you are buying they. Within underwriting, they’re going to send an enthusiastic appraiser to choose the value of brand new household.

When you discover your perfect household, make an offer. When your seller welcomes (potentially once some negotiation), you might be willing to in the end get mortgage.

Action 6: Read Underwriting

Anybody can commercially submit an application for your own home loan. While you are currently preapproved, it has to stop the degree of documentation you should wade as a result of right here.

When you fill in their mortgage software, the financial institution starts the latest underwriting processes. This process form its party requires a close look within what you on the application, from the borrowing and a career records to the valuation of your own domestic you want to buy.

You may get wanted facts during the underwriting. Expect you’ll render it promptly. Also rather than delays, underwriting usually takes weeks.

Action 7: Romantic

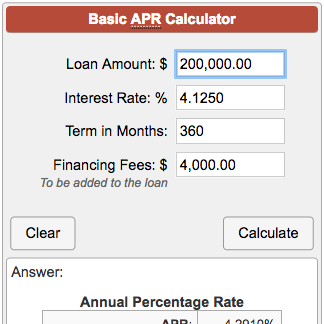

If the lender approves the loan, it is the right time to visit this new closure dining table. At this point, your finalize all the documentation on the each other their financial and you will the purchase agreement to suit your new home. You will also have to pay closing costs, the bulk of which often come from the financial institution. Of numerous loan providers costs app and financing origination costs, including.

You’ll be able to walk away on the payday loans in Edwards no credit check closing table which have less overall when you look at the your own pouch, however you will have the rewarding inclusion out-of possession of one’s the brand new household.

You’ll not very own your house downright if you don’t become paying the financial. Until the period, their mortgage contract offers your own bank a claim to the house in the event you avoid paying. Whenever you stand through to your repayments, even if, you really need to get-off the new closing dining table prepared to live your life within the your brand new house.

Home financing is the most frequent cure for pick a good family, nonetheless it isn’t the best possible way. Here are some alternative methods in order to a bank-provided financing.

Dollars Profit

If you find yourself fortunate enough to obtain the dollars (or possessions you could potentially bring in cash), you certainly do not need so you can include a loan provider when buying a house.

Rent-to-Own

Particular providers can help you book a house and you will devote area of the rent commission on dominant harmony toward the home. For those who wade that it route, make sure you has a bona fide house lawyer study your deal or any other plans to make sure your passion try secure.

Obtain Out-of Retirement Offers

The fresh new Internal revenue service rules will let you borrow funds from the 401(k) to the acquisition of a property. But you can simply borrow as much as 50% of your vested balance otherwise $fifty,000, whichever are quicker. Therefore you’d probably have to couples this plan that have another on this record to cover the fresh new totality off a home pick.

Withdrawals of a great Roth IRA try income tax- and you will penalty-100 % free if you only withdraw the main and you may you have encountered the account fully for 5 years or higher, and this membership could be a source you might draw onto loans your residence get.

If you choose to withdraw otherwise acquire from your old age account, carefully consider the possibility cost of having that money spent as opposed to deploying it to purchase a property. You are deteriorating your own much time-label intends to fulfill the short-label requirements.

Supplier Resource

Particular manufacturers are happy to play the role of the bank and you will undertake installments for their assets. Such a bank, they typically fees notice because of it plan, but they is almost certainly not just like the exacting inside their conditions to have a down payment, debt-to-money ratio etc because a financial is. If you go that it station, has actually a bona fide estate attorneys oversee new bargain.