In this post

- Exact same Target, Some other Way of life Problem

- Refinancing a mortgage Cost for the Georgia

- Alternative Options for Refinancing

- Attempting to sell the house as an option

- Maintaining a joint Household and you will Mortgage

- Heading out and you can Shifting

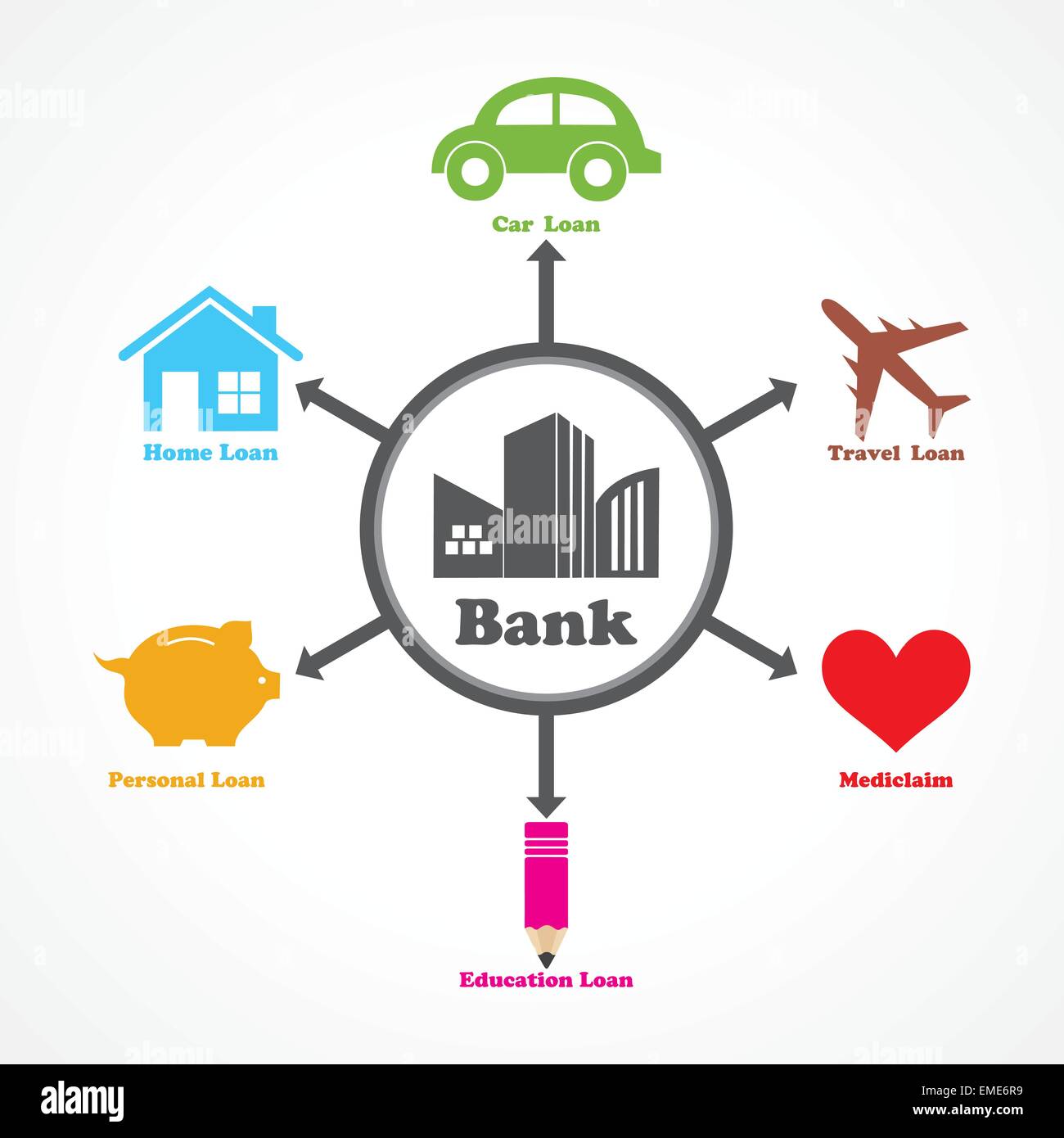

Divorce-it’s an interest to not ever be taken gently, and if you’re scanning this, odds are you are facing certain tough decisions. Among the leading mortgage lenders from inside the Georgia, our company is wishing to help you stop biggest errors making one of those decisions just a little bit convenient as you envision the options on the casing during and after this new separation. Approximately sixty% of individuals who divorced in the 2022 had their homes, for example it weighed its selection also, instance refinancing its home loan rates when you look at the Georgia, offering your house, otherwise keeping a combined household and you may mortgage. The best choice depends on your situation, but your choice-and make procedure can go effortlessly armed with some a guide.

Exact same Target, Additional Way of living Disease

The conclusion a marriage try an emotional sense, additionally the current housing industry actually enabling. Just like the financial cost within the Georgia are as high as eight% and you may average home prices has increased, of numerous lovers is caught from inside the an uncomfortable houses condition. As in, they cannot go out they have together. Also renting even offers a challenging provider given that rents possess grown so much more than simply 9% within the last two years.

It means specific couples is obligated to alive together for much longer than they had such-which includes divvying in the floors regarding a multi-peak family, delegating independent home cabinets, and you can messaging about washing area use. Its a complex (and you may exhausting) material to undergo whenever tackling a lives-changing feel. But unsecured personal loans Avant if you put obvious boundaries, esteem each other’s individual place, and create separate account to pay for individual expenses, that it arrangement you can certainly do properly.

Refinancing mortgage Pricing during the Georgia

For individuals who display homeownership and are divorcing, the easiest solution is so you can re-finance the loan in such a way you to definitely departs only one individuals title towards the loan. So it eliminates the newest partner just who won’t make home loan repayments of new name to your family. Though it is the most seamless service, mortgage lenders when you look at the Georgia for example Moreira Group have experienced things such as earnings, credit, and low guarantee change the ability to effortlessly re-finance.

The latter is one thing we see a lot, given the present fluctuation in the property beliefs. If you and your spouse bought while in the an upswing, you do not have enough equity in order to refinance. But never care and attention-you have still got several options:

- Freddie Mac Increased Recovery Re-finance (FMERR): home financing-relief system designed to let people with little or no equity re-finance for the a lesser interest and you will monthly payment.

- Government Housing Management (FHA) Improve Re-finance: makes you refinance even though you has actually an underwater home loan.

- Pros Factors (VA) refinance mortgage: accessible to every branches of one’s armed forces and comes with low (or no) security advance payment alternatives.

Solution Alternatives for Refinancing

Now, most people enjoys a current financial rate less than 4%, which includes as grown to a lot more than 6%, dependent on field fluctuation. In lieu of mobile owning a home to just one people (which will need refinancing), particular exes possess accessible to get one person stay on the brand new home loan to preserve the pace and you can pay off its ex’s percentage of the brand new guarantee-in addition to fancy. This will keeps their cons, although. A partner who stays towards the a contributed financial immediately after a splitting up is almost certainly not in a position to qualify for a different financial someplace else. And you will, naturally, often there is the possibility of non-commission, which will connect with both parties’ fico scores.