Experts United Rates and you can Charge

Experts Joined offers their most recent Virtual assistant loan interest levels to the the webpages. Depending on the newest data, Pros United’s costs is a bit below or on the level on federal mediocre for 31-12 months and you may 15-season fixed-speed Va money.

Sadly, Experts United doesn’t reveal the cost to possess low-Virtual assistant fund, it is therefore tough to give how they accumulate to the race. That being said, good lender’s mediocre pricing aren’t always reflective of your rates possible be provided. To acquire a personalized rate quotation when it comes to form of mortgage regarding Pros Joined, together with a Va mortgage, you’ll have to glance at the pre-recognition procedure and accept a hard borrowing from the bank query.

Taking numerous quotes is important while looking for home financing. In reality, according to a report by Freddie Mac computer, individuals whom seek about five prices enjoys the common yearly discounts off $step one,2 hundred. Yet another study from the Government Reserve Lender off Philadelphia learned that trying one or more a lot more price offer contributes to an enthusiastic 18-basis-point rate reduction and you can good twenty eight-point prevention getting all the way down-earnings borrowers.

And additionally your loan rate of interest, you’ll also pay certain mortgage costs. Veterans United costs an apartment 1% origination commission on the money, which is on the luxury regarding typical for almost all loan providers. If you find yourself taking right out a beneficial Va loan, you’ll also need to pay good Virtual assistant capital payment, but that’s energized because of the Virtual assistant in place of Veterans Joined and you will have a tendency to implement no matter what bank you use out of.

On the internet Feel

Pros United’s webpages is relatively very easy to browse. The fresh pre-approval techniques is simple and you may mind-explanatory. Possible look for tips like informative articles, home loan hand calculators, the brand new homebuying path, credit consulting guidance, Va loan pricing, plus.

In which you could possibly get have a problem with Veterans United’s website is if you may be trying to get financing except that good Va financing. If you find yourself Experts Joined also provides antique loans, FHA fund, and you will USDA loans, it does not build information about those individuals funds freely available into its web site, nor will it disclose interest rates with the those finance.

Customer service

One of several places where Veterans Joined really stands aside is actually within the support service. It has 24/7 customer care to suit their overseas consumers-it is especially important offered the work at Va funds. You could potentially contact the business via mobile phone, email address, post, otherwise certainly one of their various social media users.

Client satisfaction

Pros Joined has absolutely outstanding customer satisfaction results. First, the lender gets the highest ranking of any financial within the J.D. Power’s 2023 You.S. Mortgage Origination Satisfaction Investigation. Additionally, it keeps an average rating off cuatro.nine from 5 celebrities on the Trustpilot. It’s got over eleven,000 feedback and 96% of these is 5-superstar product reviews.

Many studies compliment their excellent customer support together with ease of your homebuying procedure. But not, its well worth noting that all of these evaluations particularly resource Virtual assistant loans-it’s difficult to track down feedback out of people who possess obtained most other mortgage brands of Veterans United.

Membership Government

After you personal for the a home loan, loan providers get offer the mortgage to some other loan servicer. Veterans Joined does not divulge whether it transmits otherwise sells its fund to some other servicer.

In the event the Veterans United maintains your house financing, you could potentially would they from your own on line membership or cellular software. Here, you can song and you may manage your payments, and additionally setting-up vehicle-spend.

Pros United is not an entire-solution financial institution, definition it does not bring banking or any other comparable economic characteristics. However, the business possesses a couple most other related services.

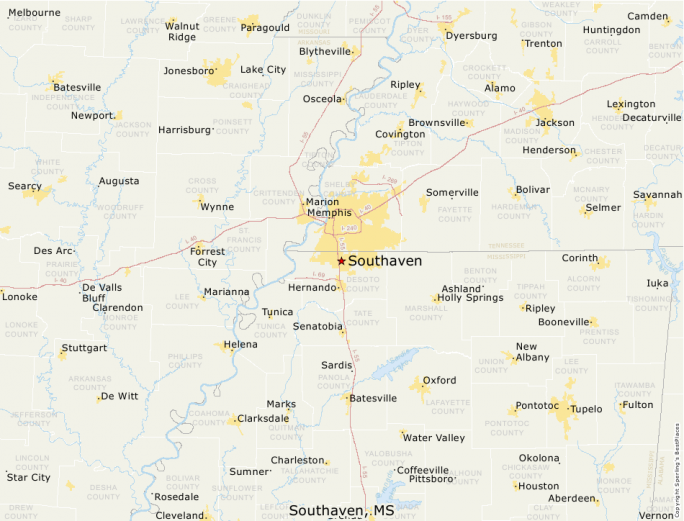

First, Veterans United Realty was a joint venture partner lover of the lender. This has a national network of real estate agents regarding You.S. you to specialize in enabling pros buy residential property. Consumers exactly who play with one payday loans Lakeside another Experts Joined Realty and Experts United House Funds may be eligible for certain coupons to their settlement costs or rate of interest.