In case the customers pays off the complete balance of its mortgage before prevent of your promotion several months, they’ll not need to shell out any interest fees.

Reduced rates loansThis option is best for customers who are in need of a good longer period of time to settle the financing. These funds provides a lower Apr and can enjoys a cost age of around 12 many years.

When a customers believes in order to a great GreenSky loan, their GreenSky account matter may be used eg a credit card along with your fee processor chip. The bucks would-be deposited to your account, then it will be the user’s responsibility to spend right back this new loan to GreenSky.

Each and every time a consumer determines a good GreenSky financing solution, your company was energized an exchange commission. GreenSky doesn’t specify what the exchange payment is equal to unless you is actually approved in their seller circle. Each month, you will found an invoice for everybody of one’s purchase charges you to definitely collected regarding the previous few days.

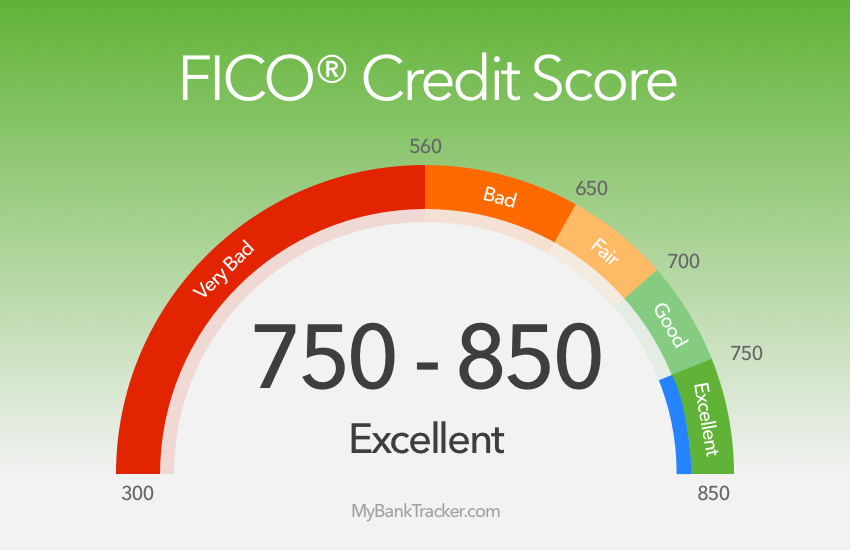

There isn’t any lowest credit score necessary of your consumers in the purchase so they are able sign up https://cashadvanceamerica.net/installment-loans-tn/ for a good GreenSky mortgage. But not, GreenSky usually nevertheless carry out a hard credit query, which has the potential so you can adversely impression their credit history. It is additionally vital to note that a consumer’s reduced credit history could possibly get perception their attention price.

What’s Medallion Lender?

In lieu of Greensky, Medallion Lender does not have to perform partnerships having finance companies otherwise borrowing from the bank unions while they themselves are the bank providing the loan. Medallion finance around $65,000 getting home improvement programs, and solar installations.

Whether your solar setting up team fits the above criteria, you could potentially sign up which have Medallion. Shortly after acknowledged, you will be able giving user financing alternatives for those individuals whom are unable to get a space outright.

Area of the financing one Medallion even offers is exactly what is known as a simple installment financing. Whenever a buyers decides to explore a simple fees mortgage with Medallion, they are able to use making use of the Medallion Bank cellular app otherwise web site, in which they may be acknowledged within seconds.

Medallion Lender operates a credit check on the customer to decide what interest rate it be eligible for. The customer will likely then provides low monthly obligations to expend right back their Medallion loan.

In the event the customers has best credit, meaning the credit score are 661 or a lot more than, you will not be billed any fees by the Medallion Lender. So, after you sell a solar power system to a customers which have finest borrowing, you earn the main benefit of devoid of to expend one fees for the transaction!

Opting for anywhere between individual finance companies

Both Greensky and you will Medallion can help you pertain individual financial support getting your web visitors. According to your organization needs, you to was better than the other.

The way it is to own GreenSky Borrowing from the bank

GreenSky doesn’t have strict app standards for example Medallion do. Therefore, when you have a business that makes less than $1 million per year within the funds or might have been discover having below a couple of years, GreenSky is the better choice for your.

It is very important consider GreenSky’s deferred appeal promotion, too. Customers would be significantly more prepared to pull out that loan in the event that there is a possibility which they need not pay attention in it. It indicates alot more company for your company.

The outcome to possess Medallion Financial

Medallion prides in itself with the coping with reputable companies. As Medallion Bank’s attributes are only offered to people who meet the requirements, the caliber of the properties is large. Also, you will not need to pay people charges in the event the buyers enjoys a prime credit rating. So it helps you to save some money to your deal fees.